7 Tax Strategies to Keep More of What You Earn as a Tech Professional

These strategies could save you thousands of dollars in taxes this year

Dear subscribers,

Today, I want to share 7 tax strategies to help you keep more of what you earn.

Like many of you, I’d much rather focus on building great products than doing my taxes. But that has led to costly mistakes like missing retirement contributions and overlooking business deductions. The truth is:

Taking 15 minutes to learn these tactics could save you thousands of dollars.

That’s why I decided to write this guide with Carry, my favorite platform for business owners and tech professionals to grow their wealth. Note that this isn't financial advice — consult a tax professional before taking action.

1. Understand your stock options and RSUs

If you’re in tech, stock options and RSUs are likely a big part of your total compensation. Let’s break down the three types first:

RSUs (Restricted Stock Units) are shares taxed as income when they vest. Here’s what many people miss — your company typically only withholds 22% of your RSU income for taxes, but you likely owe 35-40%. So consider pre-paying your taxes in January, increasing your W2 withholding, or prepping a large bill in April.

NSOs (non-qualified stock options) are coupons that let you buy company stock at a discount. Let's say you get NSOs with a $10 strike price. If the stock rises to $30 and you exercise, you'll pay income tax on the $20 spread. Like RSUs, NSOs are taxed as regular income.

ISOs (incentive stock options) offer the best tax advantages if you plan carefully. Hold them for a year after exercise and 2 years after the grant date to qualify for the 20% long-term capital gains rate instead of your income tax rate. Watch out for Alternative Minimum Tax (AMT) if the spread is large.

Given the above, here’s how you can manage your equity:

For RSUs, decide your strategy for each vest. Many employees sell some or all of their RSUs to reduce financial dependency on their company stock.

For options, consider holding your ISOs longer than your NSOs. There's no tax benefit to holding NSOs, but ISOs can qualify for that 20% long-term tax rate.

Don’t forget the 90-day ISO rule if you leave your company. You only have 90 days to exercise your ISOs before they convert to NSOs after you leave.

Always participate in your employer's stock purchase plan (ESPP). It's usually a 15% discount on company stock that you can sell immediately to realize the gains. Note that every ESPP plan is different so do your research before taking action.

Here’s a calculator from Carry to calculate your equity and make informed decisions.

2. Calculate the upside for Traditional vs. Roth

When you have mortgage and childcare payments to make, retirement can feel like a distant problem. But recognize that:

Every dollar in your 401(k) reduces your tax burden long-term.

Let’s break down your two main 401(k) options:

Traditional (pre-tax) 401(k) lets you contribute tax-free now and pay taxes on withdrawal. Maxing out at $23K saves you $8K in taxes at the 35% tax bracket.

Roth 401(k) taxes you on contributions but offers tax-free withdrawals in retirement. Think of it as paying taxes on the seed instead of the harvest.

Given the above, here’s how you can manage your retirement accounts:

Get your employer's full match first. For example, if your company matches 50% of your 401(k) contributions up to 6% of your salary, that's an immediate 50% return. This should be your top priority because it’s free money.

Calculate your upside with Traditional vs. Roth. Traditional accounts benefit high-income earners who expect lower retirement tax rates, while Roth accounts favor those in lower tax brackets or early careers due to tax-free growth. Use a Traditional vs. Roth calculator to estimate the upside of each.

Consider a Backdoor Roth IRA. The IRS locks out married couples making $240K+ from a Roth IRA. But you can research using a Backdoor Roth IRA or a Mega Backdoor Roth to get around this.

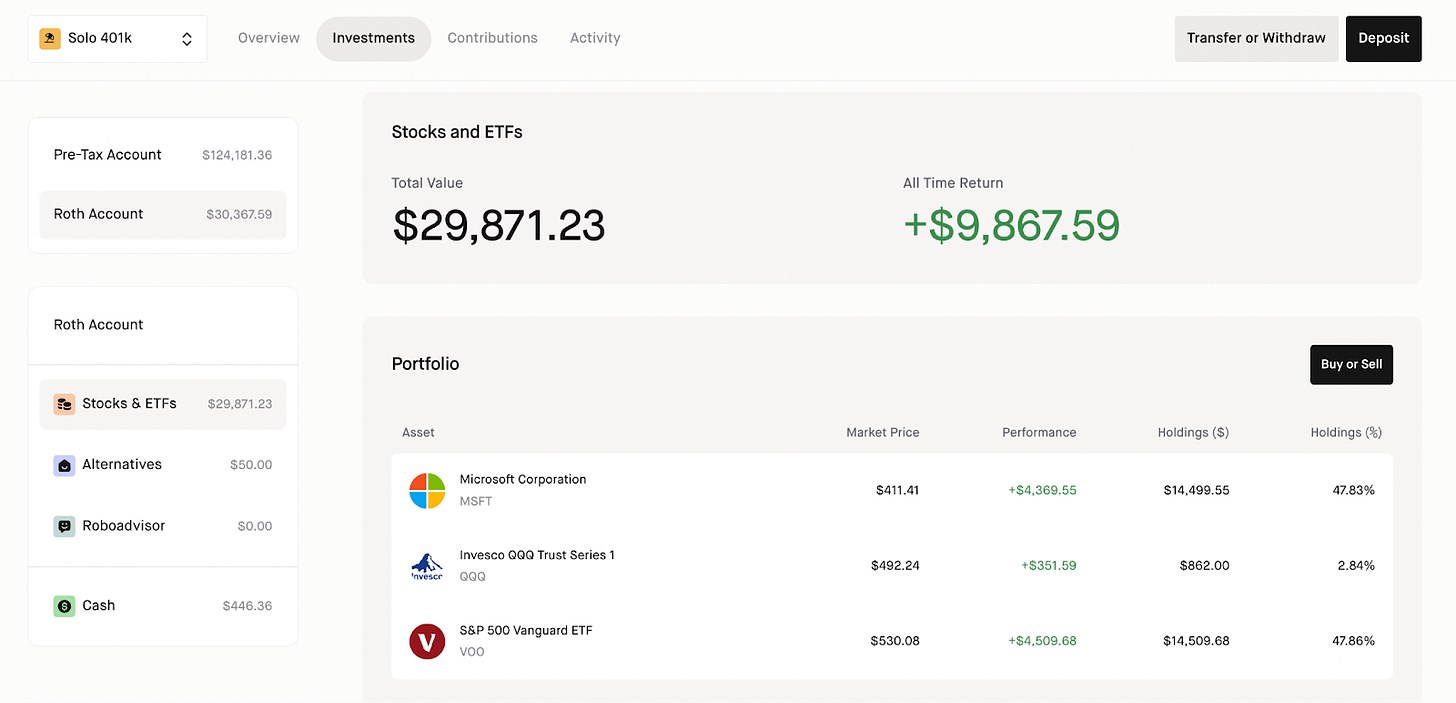

3. Consider a Solo 401(k) for your side hustle

A Solo 401(k) can be a powerful tax tool if you have a profitable side business beyond your day job. Benefits include:

Contribute up to $69,000 if you’re under 50. You can reduce your taxable income by deducting this amount.

Choose between traditional and Roth solo accounts. You can pick either one depending on your goals above.

Investment freedom. You can invest in almost any asset class, including alternative assets like startups, real estate, and private equity.

The only catch is the $23K employee contribution limit is shared between all your 401(k) plans. But you can still make "employer" contributions up to 25% of your business profit, plus optional after-tax contributions up to 100% of your profit.

So, if you have extra money to stash away, contributing to two 401(k) plans can increase your tax-advantaged savings.

4. Maximize tax savings from your side business

Running a side business opens up a world of tax deductions. Here are a few to pursue: